A Growing Economy That Doesn’t Boost Freight

by FTR | Sponsored Content, on Mar 2, 2023 3:30:09 PM

At FTR, we work hard to understand how the macroeconomic environment impacts commercial freight transportation so our clients can make smarter supply chain decisions. Given the excessive chatter that exists in the industry about looming recessions and pending cliff events, we wanted to provide the Food Shippers audience with a complimentary view of a recent industry analysis presented in the FTR Shippers Update monthly service.

The economies by the Numbers

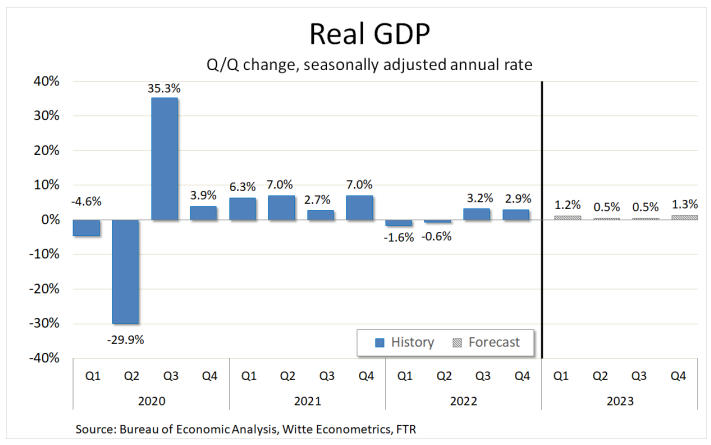

Before we launch into the analysis, we need to lay out the basics. After slight declines in the first two quarters of 2022, the U.S. economy posted two solid quarters of growth. GDP rose 3.2% quarter-over-quarter (q/q) on a seasonally adjusted basis in 2022Q3, and the gain was almost as strong in Q4 at 2.9%, according to advance data from the Bureau of Economic Analysis.

GDP growth in the second half of last year was not as robust as it had been in all but one quarter from 2020Q3 through 2021Q4. However, that period is hardly a reasonable benchmark for many reasons, the most obvious of which was trillions of dollars in consumer stimulus that now has been absent for more than a year and had declined sharply after March 2021 anyway.

A longer-run comparison shows how solid GDP growth was in Q3 and Q4 of last year. During the five years from 2015 through 2019, average annualized growth by quarter was 2.3%. The only quarter during 2018 or 2019 with stronger GDP growth than that of the final two quarters of last year was the 3.6% growth in 2019Q3.

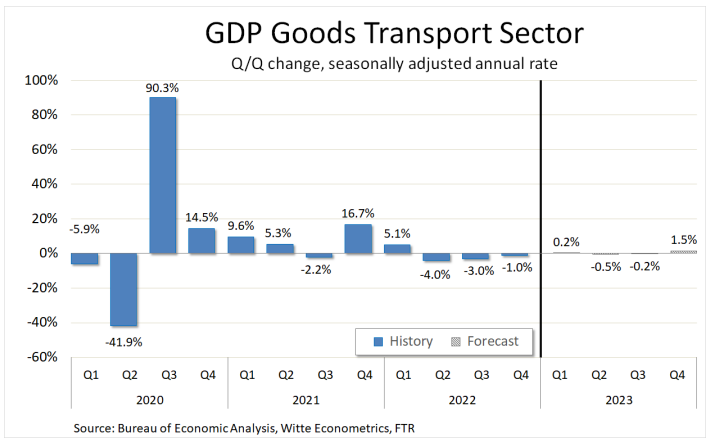

The portion of the economy linked to freight transportation – what FTR calls the GDP Goods Transport Sector (GTS) – has not fared well recently, however. In 2022Q4, GTS dipped 1% annualized for the third straight quarterly decline. At least the decreases are decelerating. GTS had fallen 4% in Q2 and 3% in Q3.

GTS also saw three consecutive negative quarters from 2019Q4 through 2020Q2, but the final quarter in that run – and to some degree, 2020Q1 as well – obviously was an outlier due to pandemic lockdowns. Before then, GTS had not declined for three straight quarters since the Great Recession.

How can the movements in the freight economy and the broader economy be so different?

An Unsurprising Dynamic

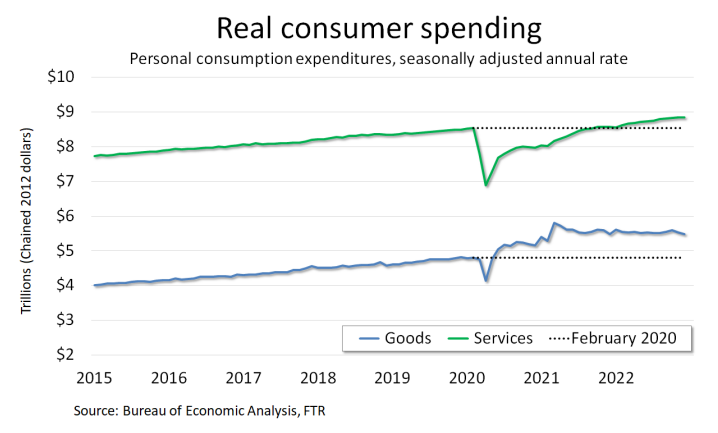

The U.S. economy has faced some unpredictable challenges – the semiconductor shortage and Russia’s invasion of Ukraine, for example – but everyone anticipated one important dynamic: The shift in consumption back to services from goods. FTR was hardly alone as early as mid-2020 in forecasting that dynamic. We knew that eventually people would begin traveling, eating out, etc., and would cut back on extraordinary spending on goods to do so. The only question was when.

Real spending on services has been a positive contributor to GDP since 2020Q3. In the wake of stimulus, spending on goods had been a much stronger contributor to GDP in 2020 Q3 and 2021 Q1. Starting in 2021Q3, however, spending on goods has been a negative for GDP in four of six quarters.

In 2022Q4, consumption was a strong positive for GDP, but the contribution from services was more than four times as large as that from goods. Spending on goods in Q4 was a positive contribution for the first time in a year, although motor vehicles and parts represented more than three-quarters of that contribution.

A Boost from Inventories

The largest contributor to GDP’s Q4 strength – accelerated investment in private inventories – also supported the freight economy. Stronger inventories are complicated, however, because while they support contemporaneous freight demand they potentially reduce future demand for goods.

Although an inventory correction in the retail sector has been a worry for months, the inventory gains in Q4 principally occurred outside the retail sector. The largest contribution was in manufacturing, led by petroleum and coal products and chemicals. Inventories in mining, utilities, and construction also were stronger.

Real retail inventories were unchanged in Q4, but that was due to a 2.5% increase in real inventories (Continued from page 10) of motor vehicles and parts, which remain about 19% below pre-pandemic levels. Excluding automotive, retail inventories declined 0.9%.

Devil in the Details

Nonresidential fixed investment was a minor positive contributor to GDP in Q4, but it did nothing to support GTS. Investment was centered within intellectual property, which has essentially no effect on freight demand. Elements of nonresidential investment that do affect freight – structures and equipment – were either negative or unchanged.

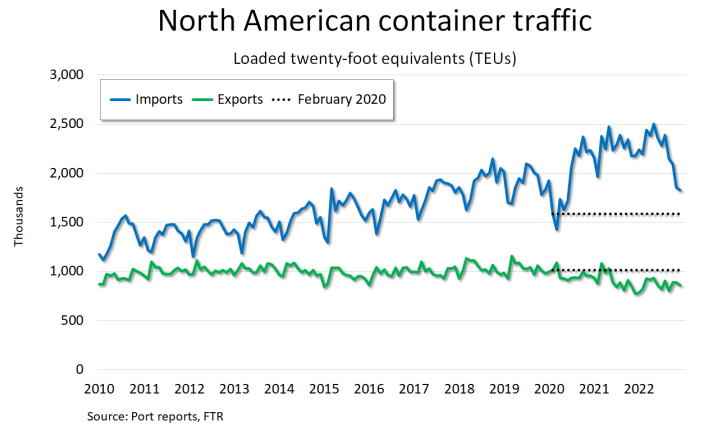

One negative factor for GDP was even more negative for GTS. After contributing strongly to GDP in Q2 and Q3, exports weakened to a small negative. Exports include both goods and services, however. Exports of services were a significant positive for GDP, but exports of goods were an even larger negative.

Then there are imports, which were weak in Q4. However, because imports count as a negative in the calculation of GDP, that weakness was a plus. Weak imports clearly hurt GTS, but the distinction between goods and services matters here, too. Imports of services were basically unchanged in Q4 while imports of goods were sharply lower.

A Weak Outlook for Both

FTR forecasts weaker economic growth in 2023, but so far that forecast does not include any negative quarters for GDP. The GTS outlook is weaker with barely any growth projected in 2023Q1 and small declines forecast for the second and third quarters. Moreover, risks to the 2023 forecast likely are mostly to the downside.

What Should You Do Next?

Head to ftrintel.com/shippersupdate-fsa now to claim your free copy of the March 2023 FTR Shippers Update! And for those seeking to elevate their market intelligence toolkit with a trusted transportation advisor, take advantage of our limited-time offer of $500 off for new subscribers. Don’t miss this opportunity to gain a competitive advantage and drive your business forward.

Like this kind of content? Subscribe to our "Food For Thought" eNewsletter!

Now more than ever, professionals consume info on the go. Distributed twice monthly, our "Food For Thought" e-newsletter allows readers to stay informed about timely and relevant industry topics and FSA news whether they're in the office or on the road. Topics range from capacity, rates and supply chain disruption to multimodal transportation strategy, leveraging technology, and talent management and retention. Learn More