Trucking Alert: On the Spot – KeyBanc Capital Markets Inc. Truckload Spot Rate Index, Week 20

by Staff, on May 31, 2022 9:15:00 AM

Report Provided By KeyBanc Capital Markets

Report Provided By KeyBanc Capital Markets

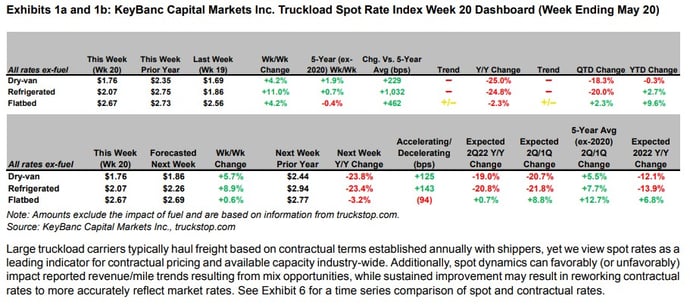

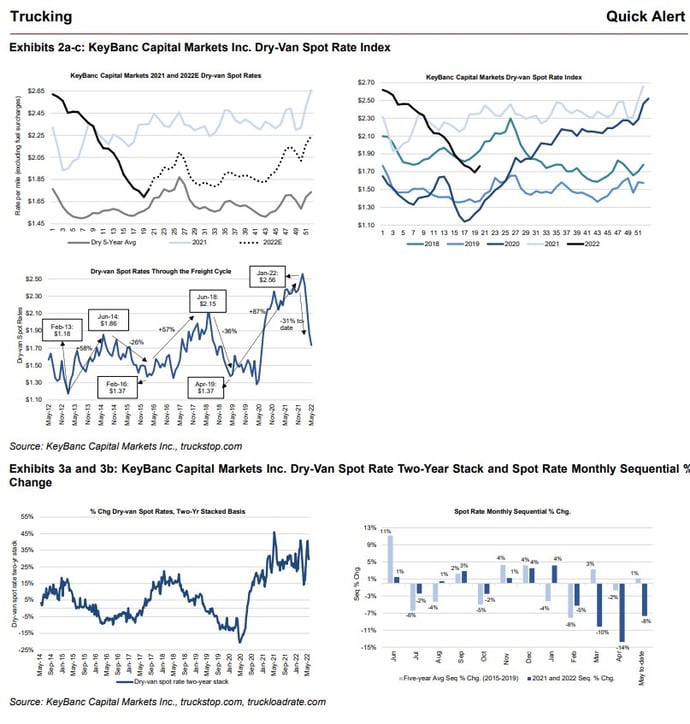

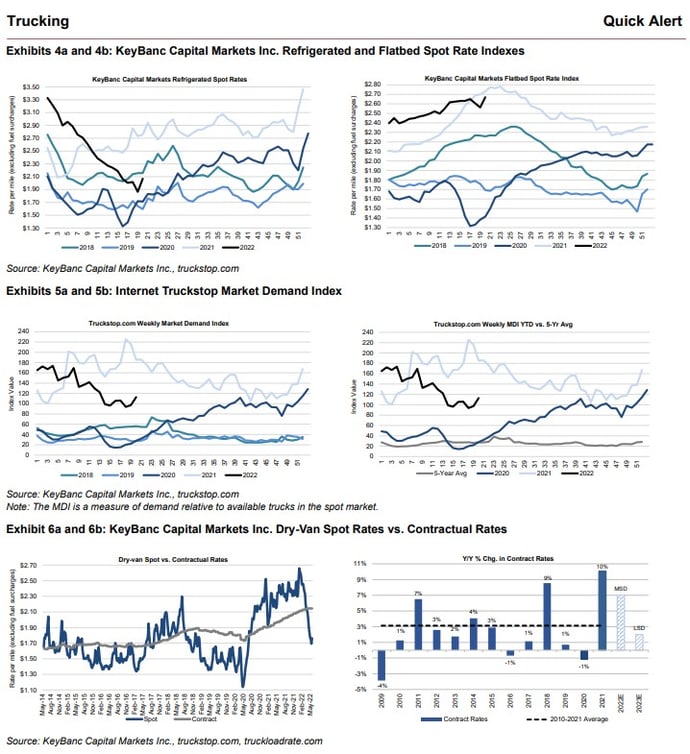

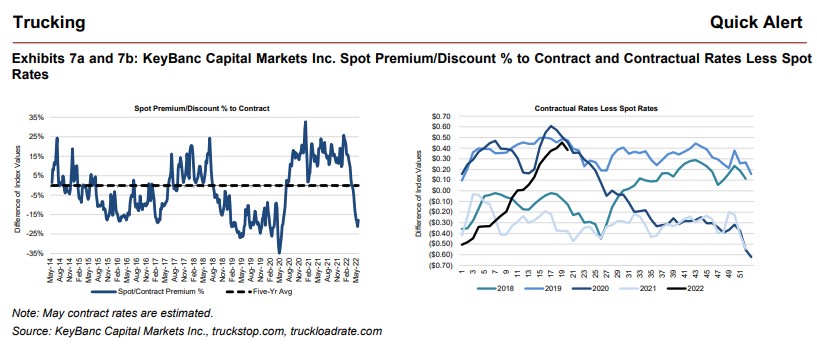

Our proprietary spot rate index bounced as expected during International Roadcheck (May 17-19), along with benefits from seasonal produce, beverage, and summer goods demand. That said, rates remain well below levels from earlier in the year, reflecting, in our view, improved labor dynamics (drivers, dockworkers), gradual easing of supply-chain constraints, and likely some moderation in goods spending from recent levels. Looking ahead, we expect rates to improve sequentially through mid-summer consistent with seasonal variations; however, with spot rates at a meaningful discount to contract and considering the historical relationship between spot and contract rates (see note here), we are cautious around 2H22/2023 contract expectations. Assuming normal seasonality from recent levels and factoring in prior-year comparisons, we expect rates to decrease 15-20% in 2Q22 (unchanged), and decrease low teens (unchanged) on a full-year basis in 2022. We expect mid-single-digit renewals in 2022 (unchanged) and flat to low-single-digit renewals in 2023.

Large truckload carriers typically haul freight based on contractual terms established annually with shippers, yet we view spot rates as a leading indicator for contractual pricing and available capacity industry-wide. Additionally, spot dynamics can favorably (or unfavorably) impact reported revenue/mile trends resulting from mix opportunities, while sustained improvement may result in reworking contractual rates to more accurately reflect market rates. See Exhibit 6 for a time series comparison of spot and contractual rates.

Disclosure Appendix

Important Disclosures

Important disclosures for the companies mentioned in this report can be found at https://key2.bluematrix.com/sellside/Disclosures.

Please refer to the analysts' recently published reports for company-specific valuation and risks.

Reg A/C Certification

The research analyst(s) responsible for the preparation of this research report certifies that:(1) all the views expressed in this research report accurately reflect the research analyst's personal views about any and all of the subject securities or issuers; and (2) no part of the research analyst's compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed by the research analyst(s) in this research report.

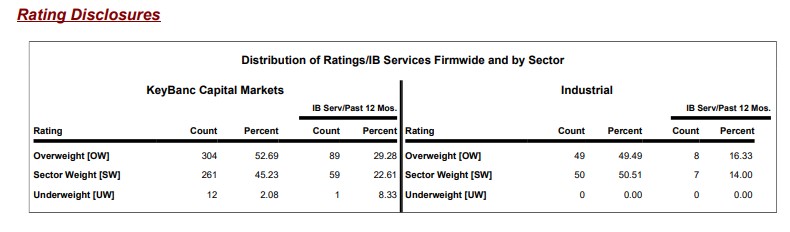

Rating Disclosures

Rating System

Overweight - We expect the stock to outperform the analyst's coverage sector over the coming 6-12 months.

Sector Weight - We expect the stock to perform in line with the analyst's coverage sector over the coming 6-12 months.

Underweight - We expect the stock to underperform the analyst's coverage sector over the coming 6-12 months.

Download Trucking Alert: Truckload Spot Rate Index, Week 20

Like this kind of content? Subscribe to our "Food For Thought" eNewsletter!

Now more than ever, professionals consume info on the go. Distributed twice monthly, our "Food For Thought" e-newsletter allows readers to stay informed about timely and relevant industry topics and FSA news whether they're in the office or on the road. Topics range from capacity, rates and supply chain disruption to multimodal transportation strategy, leveraging technology, and talent management and retention. Learn More