Q4 Freight Patterns Help Predict Trucking Economy

by Loadsmart | Sponsored Content, on Feb 7, 2023 11:02:19 AM

The trucking industry is cyclical, which means you can count on history to repeat itself, according to Felipe Capella, CEO of Loadsmart, a cutting-edge technology company with strategic partners to help food shippers and carriers move freight. “This makes understanding where the market has been essential to predicting where the market is going,” he continues. Looking at Q4 freight data, Capella’s team of data engineering experts have compiled several key predictions and industry observations that food shippers need to know:

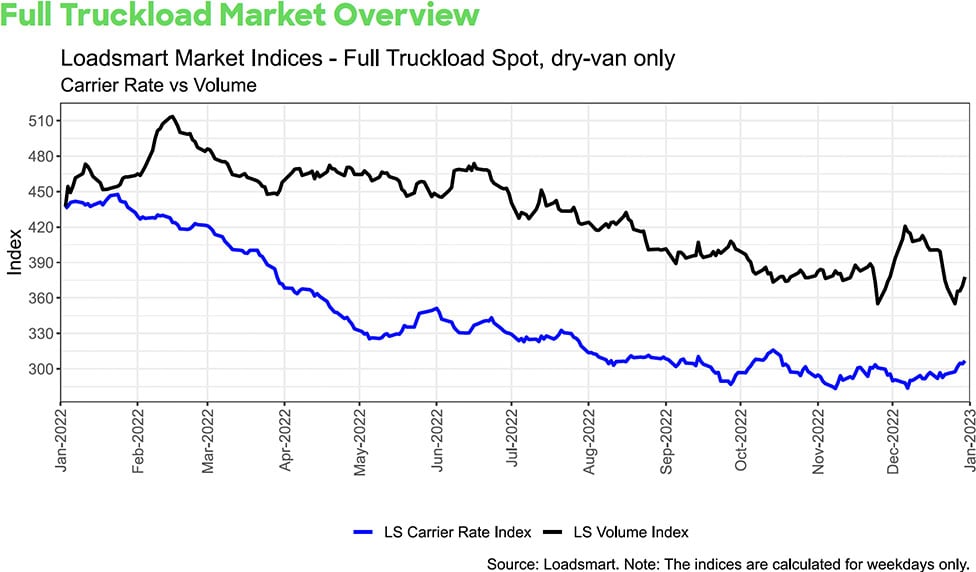

Truckload Rates

Loadsmart’s volume index declined 2% in December although the index’s average over the month was 3.6% higher than in November. There was a clear holiday bump similar to 2021-2022 - demonstrating that the holiday season was not entirely muted. In addition, Loadsmart’s price index increased 6% in December. Prices remained somewhat constant during the first two weeks of the month, but took an upturn in the third week as the holidays approached. The small hike in rates was generalized across regions. Our index’s behavior was similar to both DAT and Sonar VOTRI data, both started rebounding in the third week of December. Sonar VOTRI soared 50% in December, the biggest MoM rise in 2022 - this is expected to come back down as carriers return to work.

Full Truckload Market Overview

Loadsmart Market Indices - Full Truckload Spot, dry-van only Carrier Rate vs Volume

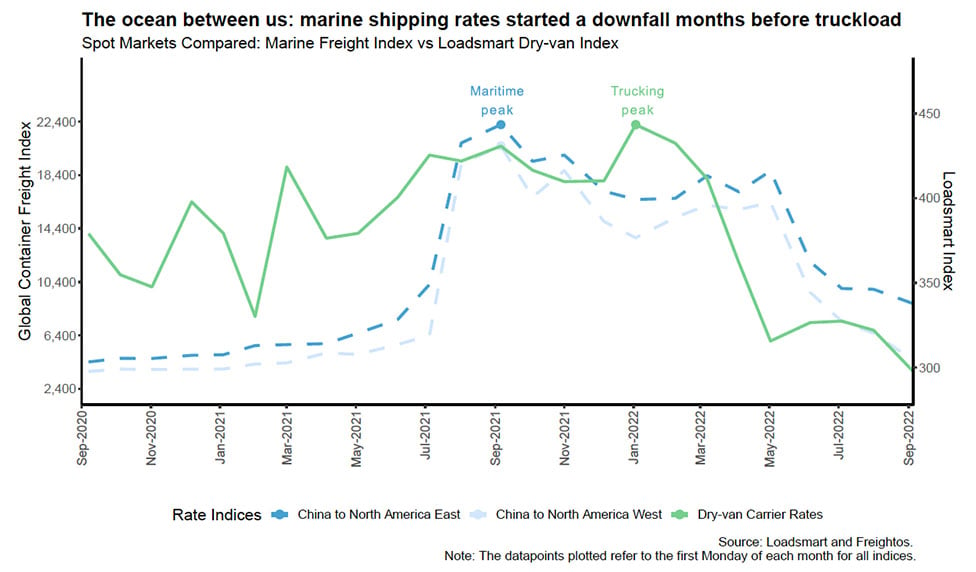

Ocean Freight

Marine shipping rates started their downfall months before truckload. Overseas maritime shipping started its downtrend four months before trucking. The ocean freight market likely encouraged shippers to keep pushing for lower rates on land as well. The fact that ocean rates have not yet found a floor makes trucking rates more susceptible to further drops – the lower demand for imports might have highlighted the fact that consumer pullback will continue. In addition, market-wise the looseness of the ocean freight market likely encouraged food shippers to push for lower rates on land as well.

Signs from Overseas

Download the Quarterly Freight Data Report:

How the Q4 Trucking Economy Will Shape Q1 2023

Understanding the cyclical nature of the market helps food shippers to make better predictions. This report will give insights to these questions:

- Will we finally reach the floor of the spot market?

- Will contract rates take a more dramatic dip to meet up with spot rates?

- Will freight volumes soften further?

To download this FREE report, use the QR code or enter: https://bit.ly/shipperdata

To download this FREE report, use the QR code or enter: https://bit.ly/shipperdata