Truck Tonnage Index Increased 2.1% in December

by Staff, on Jan 23, 2024 12:45:17 PM

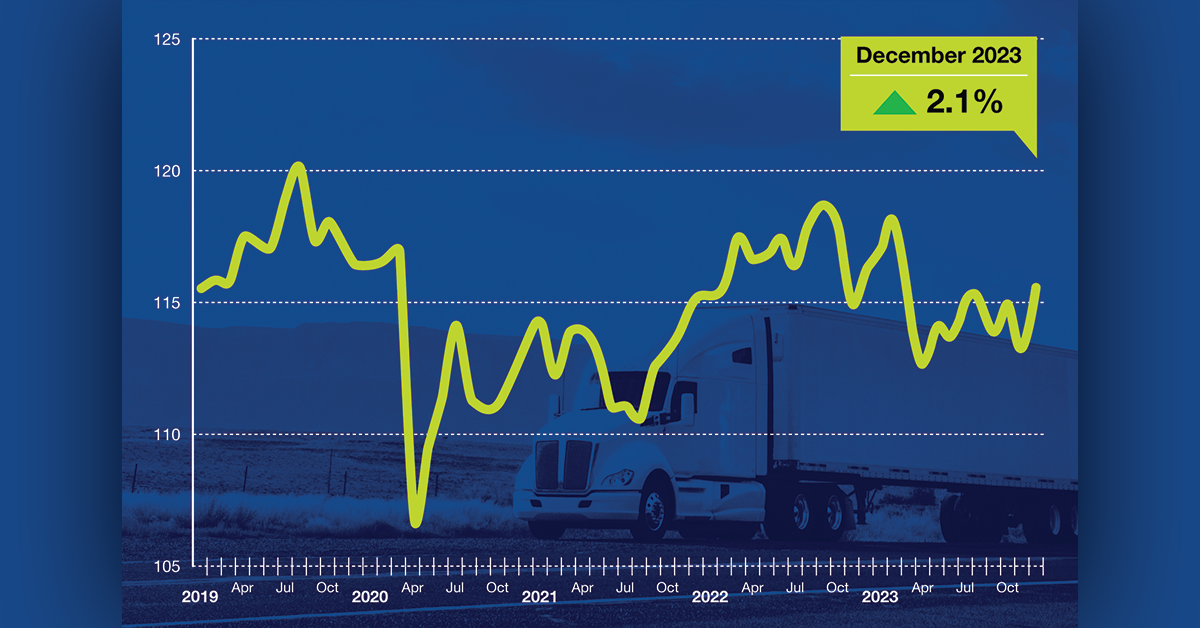

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 2.1% in December after falling 1.4% in November. In December, the index equaled 115.7 (2015=100) compared with 113.3 in November.

“While 2023 ended on a better note, truck tonnage remained in a recession as it continued to fall on a year-over-year basis,” says ATA Chief Economist Bob Costello, one of the most respected authorities on the freight economy who regularly speaks at the annual Food Shippers conference. “With that said, for-hire contract freight, which is what comprises our index, in December was 2.6% above the trough in April. For the entire year, tonnage contracted 1.7% from 2022 levels. This makes 2023 the worst annual reading since 2020 when the index fell 4% from 2019, and the only year since 2020 that tonnage contracted.”

“While 2023 ended on a better note, truck tonnage remained in a recession as it continued to fall on a year-over-year basis,” says ATA Chief Economist Bob Costello, one of the most respected authorities on the freight economy who regularly speaks at the annual Food Shippers conference. “With that said, for-hire contract freight, which is what comprises our index, in December was 2.6% above the trough in April. For the entire year, tonnage contracted 1.7% from 2022 levels. This makes 2023 the worst annual reading since 2020 when the index fell 4% from 2019, and the only year since 2020 that tonnage contracted.”

November’s decline was revised down slightly from our December 19 press release.

Compared with December 2022, the SA index fell 0.5%, which was the tenth straight year-over-year decrease, albeit the smallest over that period. In November, the index was down 1.6% from a year earlier.

The not seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 110.7 in December, 1.9% below the November’s level (112.8). In calculating the index, 100 represents 2015. ATA’s For-Hire Truck Tonnage Index is dominated by contract freight as opposed to spot market freight.

Trucking serves as a barometer of the U.S. economy, representing 72.6% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 11.46 billion tons of freight in 2022. Motor carriers collected $940.8 billion, or 80.7% of total revenue earned by all transport modes.

ATA calculates the tonnage index based on surveys from its membership and has been doing so since the 1970s. This is a preliminary figure and subject to change in the final report issued around the 5th day of each month. The report includes month-to-month and year-over-year results, relevant economic comparisons, and key financial indicators.

Related Articles:

- Truck Tonnage Index Decreased 1% in November

- Truck Tonnage Increases 1.1% in October 2023

- Truck Tonnage Index Falls 1.1% in September 2023

- Truck Tonnage Index Rose .2% in August 2023

- Truck Tonnage Index Decreases .8% in July 2023

- Truck Tonnage Index Increases 2.1% in June 2023

- Truck Tonnage Index Increases 2.4% in May 2023

- Truck Tonnage Index Decreases 1.7% in April 2023

- Truck Tonnage Decreases 5.4% in March 2023

- Truck Tonnage Increases 1.2% in February 2023

- Truck Tonnage Increases 0.7% in January 2023

Like this kind of content? Subscribe to our "Food For Thought" eNewsletter!

Now more than ever, professionals consume info on the go. Distributed twice monthly, our "Food For Thought" e-newsletter allows readers to stay informed about timely and relevant industry topics and FSA news whether they're in the office or on the road. Topics range from capacity, rates and supply chain disruption to multimodal transportation strategy, leveraging technology, and talent management and retention. Learn More