Uncharted Territory for Trucking Capacity

by FTR | Sponsored Content, on Apr 10, 2023 11:46:51 AM

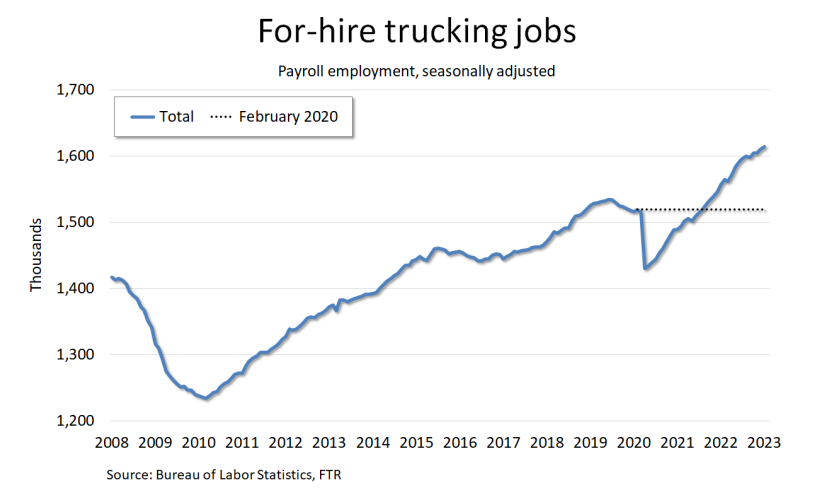

On the list of dynamics that are not operating the way they did before the pandemic is the link between for-hire trucking’s payroll employment and freight demand. That disruption should not affect the connection between overall driver capacity and volume changes in 2023, but it could affect how for hire market players fare during the year.

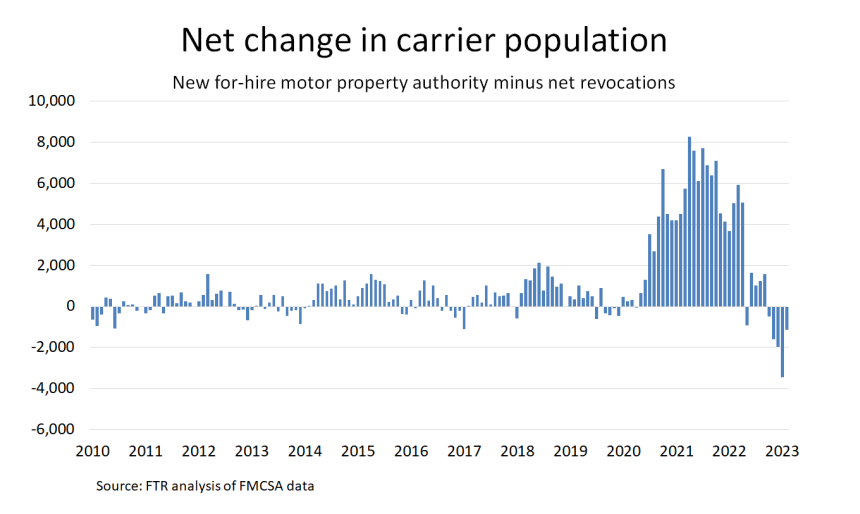

The notable shift in capacity from large carriers to small carriers that occurred in 2020 and 2021 creates uncertainty for the coming year. Even if freight continues to fade, small carriers might continue to bear the brunt. If so, demand for drivers and equipment among larger carriers could hold up and possibly even rise slightly. On the other hand, stability in spot rates and lower fuel costs might set the stage for those small carriers to stick around and siphon off volumes.

Revisiting the disconnect

Trucking’s surge in payroll employment last year occurred in the second quarter, but the rest of 2022 still saw growth. Trucking added 19,200 payroll jobs, seasonally adjusted, during the second half of the year. General freight truckload accounted for 9,000 of those added jobs.

During that same period, however, FTR estimates that total seasonally adjusted truck loadings fell 2.3% and that dry van loadings dropped 3.1%. Refrigerated freight was more resilient, falling 1.2% in the second half. Volume in both segments was frontloaded in 2022, at least on a seasonally adjusted basis.

The disconnect between load volume and payroll employment might be unusual, but it is no real mystery. As we have discussed frequently, 2022 saw a rather rapid normalization of the spot market, shifting activity back toward route guide freight.

Drivers who had obtained their own authority to haul spot freight from late 2020 and through early 2022 started to return to larger carriers in large numbers. January 2023 saw records in both net revocations of authority and net decline in the number of trucking companies. However, the process of formally revoking authority takes 30 days at the very least, and in most cases it probably is a couple of months or more. So the January figures really reflect what happened during the fall of 2022.

Payroll job figures confirm that larger carriers absorbed many of those displaced drivers, but that does not mean overall capacity rose. Very small carriers are largely invisible in the Bureau of Labor Statistics’ establishment survey, so payroll job figures continued to rise even as overall freight activity was falling and small carriers were failing. Trucking companies also might have shed leased owner-operators as they added more drivers.

Key Questions for 2023

FTR forecasts a decline in overall truck loadings in 2023, but the van segments generally look stable during the year. Dry van’s cooling already occurred in the second half of 2022, and the trendline for 2023 is mostly stable off that lower base. The dynamic for refrigerated is similar, although steady growth through 2023 is the forecast. The drop in volume over the course of 2023 is centered within the specialized segments, especially flatbed.

Although we do not have hard data by segment on the surges in new carriers and net revocations, the timing of those trends relative to spot market volume and rates strongly implies that the capacity shifts have occurred primarily in the van segments. If so, the key question now is whether small carrier failures have peaked or are just getting started.

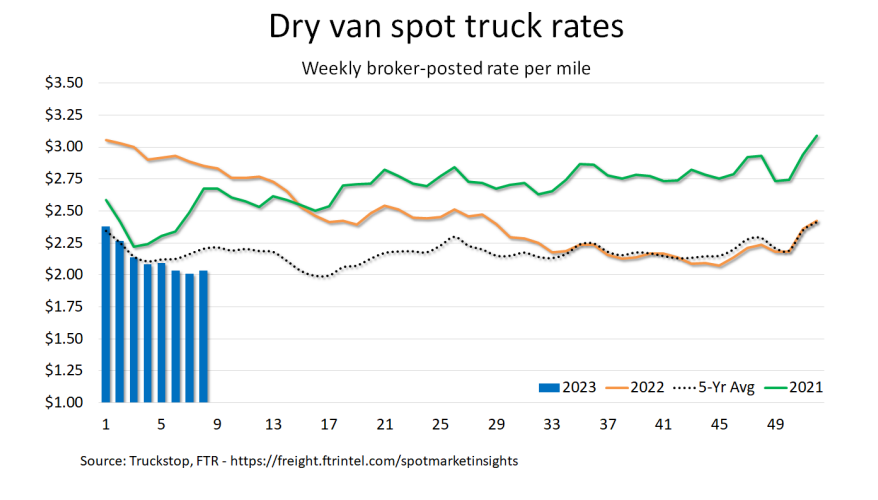

Given that the dry van and refrigerated segments have already taken almost all of their hit in truck loadings – at least according to FTR’s forecast – the availability of freight alone should not trigger any acceleration of carrier exits. Moreover, while recent spot volumes in the van segments are lagging the five-year average, they aren’t falling.

Spot rates are a bigger question. Dry van and refrigerated have eased steadily, though not sharply, this year. After falling from record levels at the end of 2021, van rates tracked closely with five-year average levels from August through January 2023.

In February, broker-posted rates in both segments – especially in dry van – began to lag the five-year average. However, the latest week saw an increase. Also, the five-year average for February rates is skewed somewhat higher by unusual strength in February 2021 due to weather and still very high – though declining – rates during February 2022.

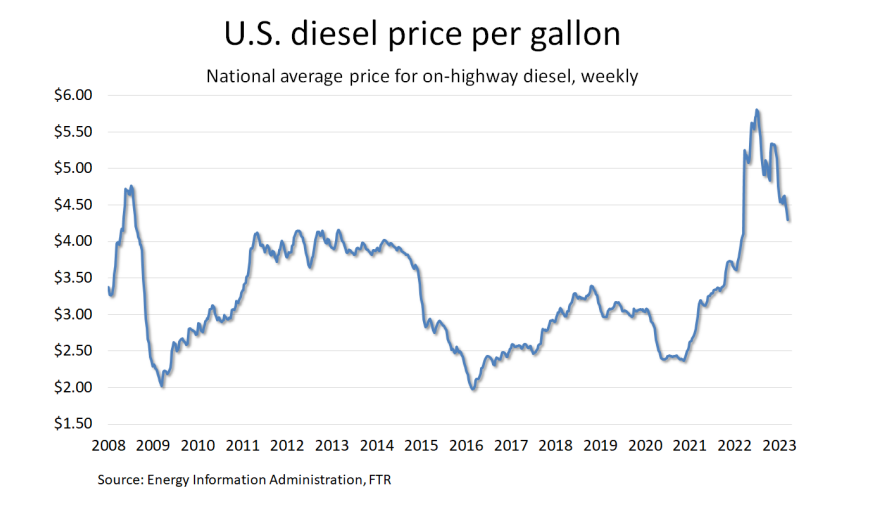

Another key factor is the price of diesel, of course. In January, we explored the effect of diesel prices on small carrier margins and potential survival, but an update is in order.

Diesel prices are still higher than they were before Russia’s invasion of Ukraine a year ago, but they have been falling steadily. Further moderation seems likely as crude prices have been quite stable, and distillate inventories have recovered after periods of significant tightness in 2022.

A continued easing of fuel costs obviously would represent a boost for small carriers operating in the spot market and relying on all-in spot rates. Conversely, an upturn in prices could trigger failures, especially if spot rates deteriorate.

A Less Visible Threat

Even if freight volumes and rates and fuel costs are stable or mildly favorable for small carriers, one other factor could be significant: Equipment costs.

Very small carriers today are operating trucks that they bought used (typically) either before or early in the pandemic or in 2021 or 2022. Either way, they face some challenges in the coming months.

Carriers operating older trucks are seeing higher maintenance and repair costs, and, increasingly, they need to replace those trucks. The good news is that used truck prices have been falling sharply. The bad news is that trucks are still more expensive than the ones they are operating, and financing costs have risen significantly since their last purchase.

Small carriers that purchased used trucks more recently face a different but no less daunting problem that, ironically, relates to the factor that is good news for those operating older trucks. More recent buyers of used trucks increasingly are upside down in the equipment and likely committed to monthly payments that current spot rates and volumes may not support.

Is a lack of actionable insights in your market intelligence processes leaving money on the table for your organization? Find out how FTR can help you with the monthly Shippers Update subscription service. Learn more at https://freight.ftrintel.com/shippersupdate-fsa.

Like this kind of content? Subscribe to our "Food For Thought" eNewsletter!

Now more than ever, professionals consume info on the go. Distributed twice monthly, our "Food For Thought" e-newsletter allows readers to stay informed about timely and relevant industry topics and FSA news whether they're in the office or on the road. Topics range from capacity, rates and supply chain disruption to multimodal transportation strategy, leveraging technology, and talent management and retention. Learn More