When Food Becomes A Target: Understanding Cargo Theft

by Staff, on Oct 16, 2025 11:06:06 AM

Cargo theft is a complex and moving target — and costs supply chains as much as $35 billion annually, according to the National Insurance Crime Bureau. Cargo theft also causes operational and supply chain disruptions, generates indirect financial costs such as insurance premium and deductible increases, and strain on customer and provider relationships.

Cargo thieves are most interested in items that can be resold easily and without detection — which means food and beverage shipments are the top category of stolen cargo, according to CargoNet. Scott Cornell of Travelers Inland Marine, who was a subject matter expert speaking at the most recent Food Shippers Annual Conference, summarized the reasons why food products are so often stolen in a discussion with CNBC in 2025: “It’s consumable. So, the evidence disappears … If you’re a cargo theft investigator and you’re trying to do a recovery investigation, the evidence is going be consumed, right? Or it’s going to spoil. There’s no barcode on a pistachio.”

Cargo thieves are most interested in items that can be resold easily and without detection — which means food and beverage shipments are the top category of stolen cargo, according to CargoNet. Scott Cornell of Travelers Inland Marine, who was a subject matter expert speaking at the most recent Food Shippers Annual Conference, summarized the reasons why food products are so often stolen in a discussion with CNBC in 2025: “It’s consumable. So, the evidence disappears … If you’re a cargo theft investigator and you’re trying to do a recovery investigation, the evidence is going be consumed, right? Or it’s going to spoil. There’s no barcode on a pistachio.”

In 2024, American Transportation Research Institute (ATRI) conducted research to provide greater understanding of cargo theft among motor carriers and third-party logistics providers (3PLs), how and where theft most often occurs, financial implications, and prevention strategies. This article highlights some of these findings of the report, which can be downloaded at no cost here at the ATRI website.

How and Where Cargo Theft Occurs

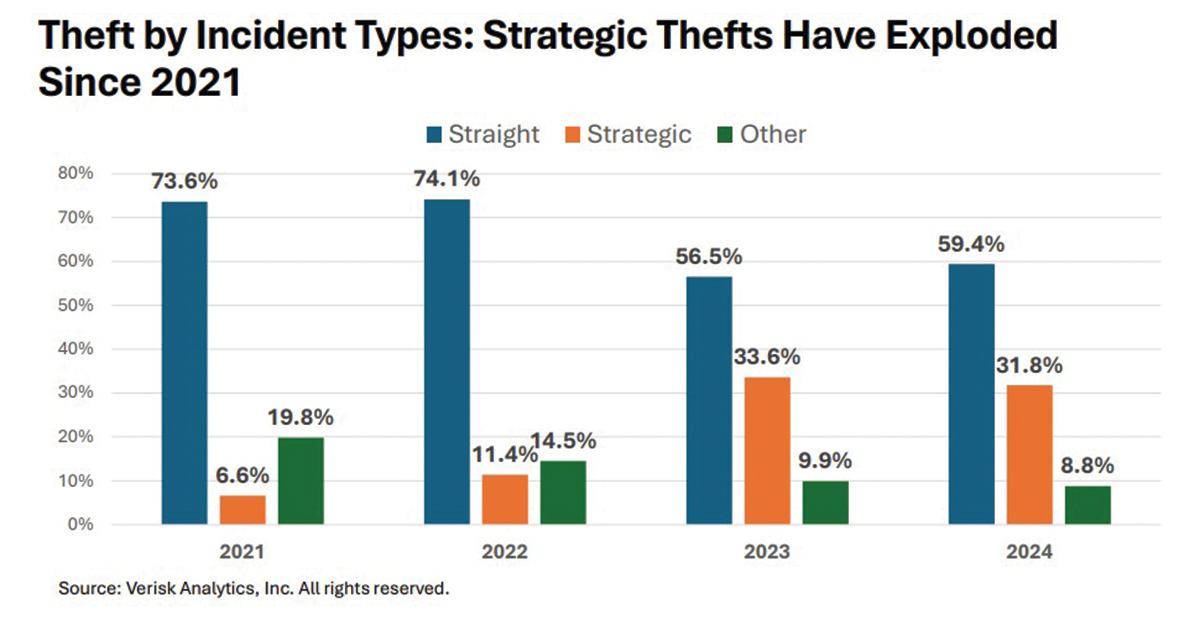

Cargo theft can be categorized into three primary forms: straight, pilferage, and strategic.

Straight theft refers to when an entire shipment of food is physically stolen from a location, often with a carrier’s truck/trailer/equipment. The FBI refers to straight theft as “when cargo is physically stolen from its current location. Cargo thieves often look for items they can steal and sell quickly. This often occurs at truck stops, parking lots, roadside parking, drop lots, rail yards and other situations where cargo is left unattended.”

Pilferage theft occurs when part of a food shipment is stolen (instead of a full load), generally when a trailer is unattended. Pilferage is sometimes not discovered until final delivery of the cargo, often at a location different from where the crime occurred. For example, pilferage may include tampering with a cargo seal and entering a parked trailer (e.g. at a rest stop) and stealing small amounts of goods. The FBI notes that pilferage can occur “when criminals alter the bill of lading and pilfer small amounts off the truck.”

Strategic theft is planned, targeted theft of specific cargo, sometimes involving load boards, fleet/identity impersonation, and/or double-brokering. Strategic theft is “when thieves incorporate deceptive tactics to commit theft. This type of cargo theft involves the use of fraud to trick shippers, brokers, and carriers into handing loads over to thieves instead of the legitimate carrier. Other current strategic cargo theft trends include identity theft, fictitious pick-ups, account takeovers, double-brokering scams, and fraudulent carriers as well as the implementation of a combination of these methods,” according to the FBI.

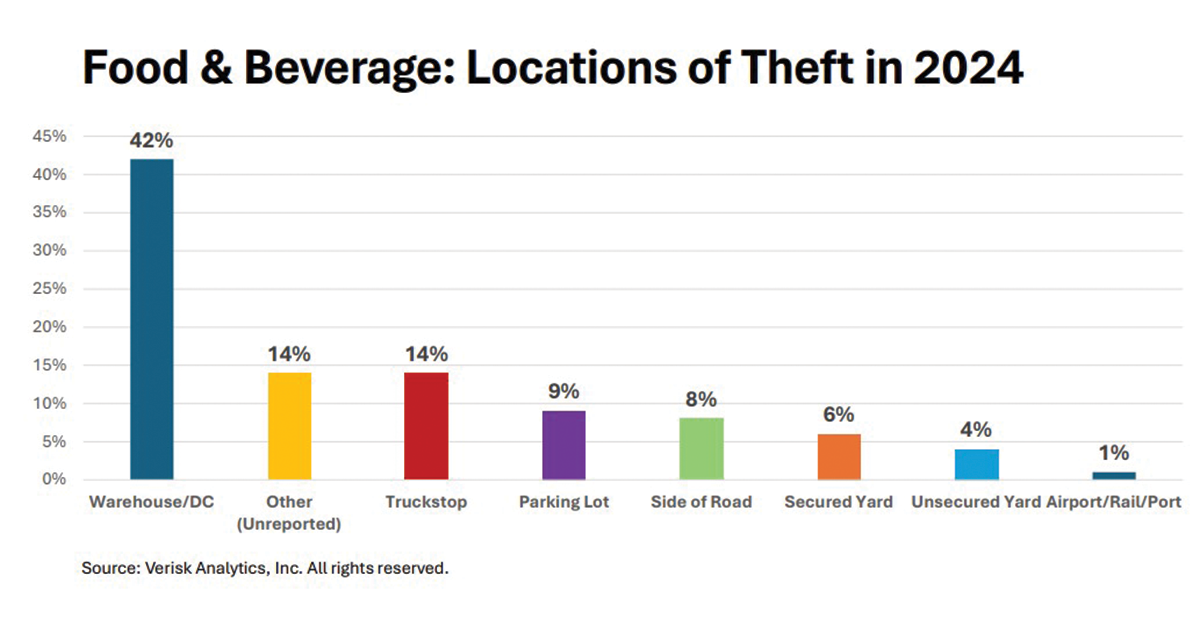

Where does cargo theft most commonly happen? While a container or trailer shipment and its cargo will travel through various facility types (both public and private), some location types are more vulnerable to theft than others. CargoNet’s latest top-ranked locations where thefts most often occur are: Warehouse, carrier terminal/lot, retail parking lot, and truck stop.

Not surprisingly, cargo thefts are more common near major freight and logistics hubs. Such locations often are in major cities with strained law enforcement, numerous busy interstate corridors, and significant freight activity. All of these factors help cargo thieves proceed undetected.

In 2023, state-level available data indicate that 41% of domestic total cargo thefts were reported to have occurred in California. An additional 12% of thefts occurred in Texas, with 11% in Illinois and Tennessee. For urban areas, trailer theft and pilferage were reportedly highest in Los Angeles, Dallas-Fort Worth, Atlanta, and New York—all major transit points for goods. Other cities that have experienced recent cargo theft spikes include Chicago, Memphis, Houston, Miami, Savannah, and Newark. Scott Cornell of Travelers Insurance noted that most of these are coastal port cities, except for Memphis and Chicago. Theft has spread to cities like Chicago and Memphis “because they’re basically inland ports with heavy rail and a heavy density in population.”

Major ports of Long Beach and Los Angeles combined with “sprawling logistics hubs like the Inland Empire,” have made Southern California the leading target for cargo thieves. Also, Texas’ unique position along the Mexican border, coupled with its vast highway network makes it a cargo theft hot spot.

The Financial Costs of Cargo Theft

The ATRI survey focuses on cargo losses to motor carriers and 3PLs in 2023. During that year, CargoNet received reports on 2,852 incidents from participating carriers, which amounted to $332 million worth of stolen cargo, with an average loss of $116,397 per incident. Beyond the financial impact, food chains are impacted in these ways:

Operational and Supply Chain Disruptions. Stolen cargo can disrupt plant operations, just-in-time manufacturing and/or final consumer needs and expectations. With for-hire or private fleets, cargo replacement activities can unexpectedly lock up additional truck drivers and equipment, all in an industry with record high costs and low operating margins.

Indirect Financial Costs. Cargo theft will have insurance implications if the theft is reported to the insurer; consequences may include an increase in insurance premiums or the need to increase already large deductibles.

Customer Relationships. Cargo theft damages carrier-customer relationships as well as food shipper-final customer relationships. Additionally, there may be disagreements over chain-of-custody responsibilities and liability arising from cargo theft.

Truck Driver Impacts. The safety of truck drivers is at risk in cargo theft incidents – especially hijacking scenarios. Such thefts can lead to truck driver retention problems, and the driver may face lost revenue and productivity if he or she is not driving in the immediate aftermath of a theft incident.

Cargo Theft Prevention Strategies

Theft prevention is a continuous and evolving effort and, in the case of strategic theft, one where adaptability is key. Protecting facilities and vehicles is foundational to a cargo theft prevention strategy. Relevant tasks include:

Protecting and Monitoring Facilities. Recognizing that fleet terminals/lots are hotspots for cargo theft, it is logical that countermeasures should begin at these facilities. Transported Asset Protection Association (TAPA) has Facility Security Requirements (FSR) Standards that set “minimum standards for security and industry best practices for facilities storing and handling High-Value Thief-Targeted (HVTT) assets.” These protections include strategies and standards for facility perimeters and entry points; workforce training and screening; and cyber security.

Protecting and Monitoring Trucks and Trailers. TAPA also has Truck Security Requirements (TSR) Standards that “set minimum security standards and best practices for over-the-road carriers of HVTT goods,” and include specific frameworks for different types of trucks, including “hard-sided” trucks, at three different audit levels. Categories covered include:

- Management support and responsibilities protocols

- Tracking, training and on-route protocols

- Workforce integrity

- Physical security

- Tracking technology and alarms

- Security procedures

- Driver security training.

Cargo theft continues to be a growing threat across the supply chain, and the food industry is a prime target. With high-value, easy-to-resell goods and time-sensitive shipments, food and beverage shipments are particularly attractive to organized theft rings. To safeguard their products and maintain customer trust, food companies should take proactive steps to reduce theft risk.

Strengthen Partnerships and Vetting. Building trusted relationships with carriers, brokers, and third-party logistics providers is essential. Food companies should conduct thorough background checks, verify insurance coverage, and confirm carrier identity before loading shipments. Using digital verification tools can help detect fraudulent operators posing as legitimate carriers.

Invest in Technology and Visibility. GPS tracking devices, geofencing alerts, and real-time telematics can give companies greater visibility of shipments in transit. When loads deviate from planned routes or remain stationary too long, alerts allow rapid response. Paired with secure communication channels, technology helps deter theft and speeds recovery.

Optimize Routing and Secure Parking. Theft often occurs when trailers are left unattended in unsecured areas. Planning routes that avoid high-risk zones and designating vetted, well-lit parking locations can minimize exposure. Even short stops should be made at monitored or partner facilities when possible.

Train and Empower Employees. Drivers and logistics staff are a company’s first line of defense. Providing regular training on theft prevention tactics—such as checking seals, avoiding oversharing shipment details, and recognizing suspicious behavior—helps create a culture of vigilance.

Collaborate and Report. Participation in industry crime networks and sharing data with law enforcement and industry groups like Food Shippers of America (FSA) and TAPA enhances collective industry awareness of the issues. Reporting incidents promptly improves investigations and helps prevent future thefts.

By combining strong relationships, smart technology, and disciplined operational practices, food companies can significantly reduce the risk of cargo theft and protect both their brand reputation and bottom line.

Related Articles:

- FSA Conference Highlights Key Focus Areas: Technology, Theft and Tariffs

- Cargo Theft Surges to Record Levels

- Bipartisan Bill to Crack Down on Cargo Theft

- How to Navigate Cargo Security and Food Safety Challenges

- Ask Our Experts: Food Safety & Security

Like this kind of content? Subscribe to our "Food For Thought" eNewsletter!

Now more than ever, professionals consume info on the go. Distributed twice monthly, our "Food For Thought" e-newsletter allows readers to stay informed about timely and relevant industry topics and FSA news whether they're in the office or on the road. Topics range from capacity, rates and supply chain disruption to multimodal transportation strategy, leveraging technology, and talent management and retention. Learn More