Anatomy of a Capacity Crisis: Underlying Trends Plaguing Supply Chains

by Noël Perry, on Feb 8, 2022 11:31:53 AM

Will We Ever Get Enough Drivers? In understanding capacity tightness in the U.S. truckload market, one must differentiate between the underlying long-run trends and short-run variations in supply and demand. The underlying trends tell us on average how hard the carriers must work to provide adequate supply. Remember that, except in extraordinary times, truckers do provide adequate supply.

However, due to demographic and regulatory trends, they must work a little harder each year to do that. In any given year, that extra work is hardly noticeable. But over time, it adds up. One can see increases in trucking costs if comparing a current year to one five or 10 years ago. Because the demographic and regulatory trends are easy to see, they get most of the attention. Unfortunately, that attention means that people commonly blame those trends for the short-run capacity crises that are increasingly plaguing supply chains.

It’s the Bursts that Get Us

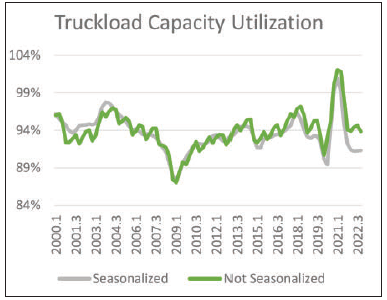

In actuality, it is the short-run, temporary variations that cause our capacity crises. Either a surge in demand or a regulatory-induced reduction in supply puts more pressure on capacity management than the carriers can handle. They eventually catch up, but not until after a period of tightness. That is exactly what has happened now.

A Perfect Storm

Three problems are simultaneously challenging the carriers. The first, and easily the biggest, is the explosion in trucking demand that has accompanied the recovery from the recession induced by the COVID-19 shutdowns over a year ago. Truck freight demand is 15% above normal, almost twice the previous record for a surge in 2004. This surge combines pent-up demand, a shift of spending from services to goods, and the unprecedented federal stimuli to the economy.

The second problem is the precipitous drop in U.S. labor participation rates stemming from COVID-19 fears and the federal stimuli that have encouraged workers to stay home. Why sleep in a truck for weeks at a time if your unemployment benefits may exceed the average wage in your state?

Third is the hidden productivity cost of the many supply chain problems associated with this surge and the COVID-19 drags. Supply chain problems require out-of-route and out-of-sequence moves that lower the productivity of the truck system. The result of all these factors, factors that have created a perfect storm, is a record burst of capacity tightness well above the previous peak in 2004.

Let’s Have No Idle Assets

Having emphasized short-run factors, it is also important to identify a critical underlying trend that contributes to this crisis. In any mature market, competitive pressures slowly but steadily reduce surge capacity.

Who wants to build the church for Easter? Such pushes for efficiency and improved financial returns have spread across global supply chains. We can see this clearly in digital chip production, unfortunately concentrated in one place, Taiwan. The explosion in product demand following the cessation of COVID-19 lockdowns was much larger than the factories could handle. It takes little engineering expertise to understand the challenges of rapidly expanding capacity in a sophisticated industry like that. We see the same thing in the Precision Scheduled Railroad programs of the major North American railroads. Precision means assigning only the precise amount of locomotive and crew capacity for normal freight flows. Throw in a surge in traffic, and the system clogs, rapidly becoming imprecise. Same thing for trucking, for manufacturing, for staffing your local restaurant. The result is a business environment full of supply chain failures: some not enough trucks; some not enough spare parts; some not enough product.

Prices Are Up, Especially in the Spot Markets

We see then powerful pressures on truck markets. So far, the contract side of the business has suffered the least because those are the steady flows, the easiest to handle. Still, we are getting increased prices as shippers bid to reserve capacity – and to place more of their freight under reliable contracts. That latter freight is harder to handle and costs more.

The real action is on the spot side of the market, usually about 20% of all moves. Two things are happening there. First, the spot market is, by definition, a place where people go to get ‘special’ capacity, serve a new lane, add 10 trucks, provide extra services, etc. With all the supply failures mentioned above, it is easy to see that this market has plenty of special capacity demand. Second, the edges of that 80% of truck freight under contract are full of questionable profitability. Maybe people bid for too much volume, or something about the service changed, or the shipper is providing unreliable volumes. In markets like today’s, carriers have abundant alternatives to such freight. As a result, they refuse those loads. Normal contract freight then has to go to the spot market. The resultant crowding drives rates up, at times close to a doubling.

Where Do We Go from Here?

Let’s take those troublesome short-run issues first. One starts by recognizing that these issues are short-run. The demand surge I mentioned above has produced four quarters with 6% compound growth; the market is 26% bigger than it was in 2020.2. Such growth cannot be sustained. I expect 1.1% growth in 2021.3, a robust number by historical standards, but well below what fleets have struggled to deal with during the last year.

You heard it here first. I expect slowing declining freight volumes for the next four years (on average). Why? Peak market anomalies like the one we have now never last. Markets are like the ocean. Waves go up and then go down. Of course, the market will stay above normal levels for some time. Still, it will begin recessing towards normal soon. So high but declining is the ticket.

It’s Not Just Trucking

Note importantly that this forecast includes two powerful macroeconomic forces. We are now at the point where the extraordinary federal stimuli should begin to soften – no more extra payments to the unemployed and less quantitative easing by the Federal Reserve.

In addition, the root of this boom has been the shift of normal consumer spending from services to goods, the stuff trucks move. Consumers are headed back toward normal. I am taking my first commercial flight in a year and a half this month. One friend is off to Majorca next week; another took a cruise last week. That means less spending on golf clubs, new cars and boats, and more on restaurants, travel, entertainment, and medical services. The economy may remain quite strong. It will just be strong in a less transport-intense way.

Maybe There Are Enough Drivers

On the supply side, unemployment benefits are finally being reduced at the same time COVID-19 fears are lessening. As they always do, the carriers will now begin to catch up with the increased demand. They will also get productivity relief as supply chains slowly solve their problems. That means less special, out-of-route freight.

Fireworks Do Burn Out

The whole collection of forces means a market moving back toward normal. That normal, of course, includes a steady compounding of normal growth. We will finish 2025 well above the market of 2019. It also requires a movement downward from its platform of temporary elevation. We will finish 2025 below the market of 2021. Prices will fall. The spot market will shrink modestly. Carriers will accept their normal percentage of contracted loads. One hopes that all will have learned the lesson about keeping higher levels of surge capacity. I doubt it. The old normal of periodic capacity crises will continue.

When Does the Bottom Fall Out?

The operable, reliable answer is sooner than most people think. Humans are inherently concentrated on their immediate environment. The Philadelphia Eagles won the Super Bowl in 2017. They should win every year, right? Truck rates are high. They will be high forever. Don’t bother me with what-ifs – I have a payroll to make this week! I need capacity! My point is that a little thinking now will put you well ahead of your competition when this wave recedes.

Tell Me When!

OK, before the hurricanes, the spot rate metrics showed us at or just past a peak. Give it two weeks for the weather effects to quiet down, and you get a very high and FLAT market by the end of September. Throw in the normal end-of-year seasonal weakness, and you get a declining spot market by January.

We also know that contract markets lag spot markets by about six months. That puts the beginning of a contract decline just after the normal seasonal peak at July Fourth 2022. Some new contracts may show price declines before then. The averages will take longer to inflect. To that timing, one can add a one-to-two-year extension, based on the precedent from 2004-2007.

Such an optimistic scenario has a downside, however. The longer the peak, the longer the time to overbuy, the steeper and deeper the decline. The 2004-2007 freight rate boom was followed by the Great Recession of 2008-2009. Markets are full of tradeoffs.

A New Normal?

Let’s go back to my opening remarks about underlying trends and short-run variation. This pandemic has clearly accelerated several underlying trends that have profound supply chain implications OVER TIME.

Online marketing, global sourcing, downtown office space come to mind. Still, that’s strategic planning stuff, not imperatives for the 2022 plan. That plan will be determined by the short-run items, ALL of which are subject to weakening strength in 2022. The current market, with its severe driver shortages, is not a new normal. It is simply the old normal intensified by the inclusion of an extra short-run disruption – the pandemic.

Everything that has happened so far is understandable in historical terms. It follows that we should expect thenormal historical pattern to repeat. What goes up must come down. That is for sure. As usual, we are not sure exactly when. But the direction is known – as should be your plans for a timely response.

This article was originally featured in the Food Shippers of America Food Chain Digest magazine.