Where Are Freight Markets Headed?

by Brian Everett, on Nov 17, 2025 2:10:04 PM

Food Chain Digest is the official magazine of Food Shippers of America. Brian Everett, Group Publisher & Editorial Director for Food Chain Digest, caught up with Lee Klaskow, Senior Freight Transportation and Logistics Analyst with Bloomberg Intelligence (BI) at the Women In Trucking Association’s Accelerate! Conference in Dallas, Texas. Klaskow shared BI’s outlook for the freight markets, discussing how economic shifts, supply chain dynamics, and policy developments are shaping opportunities (and challenges) across trucking, railroad, ocean, air and logistics subsegments. Given this economic landscape is constantly changing, it’s important to note that this information was shared Nov. 12, 2025.

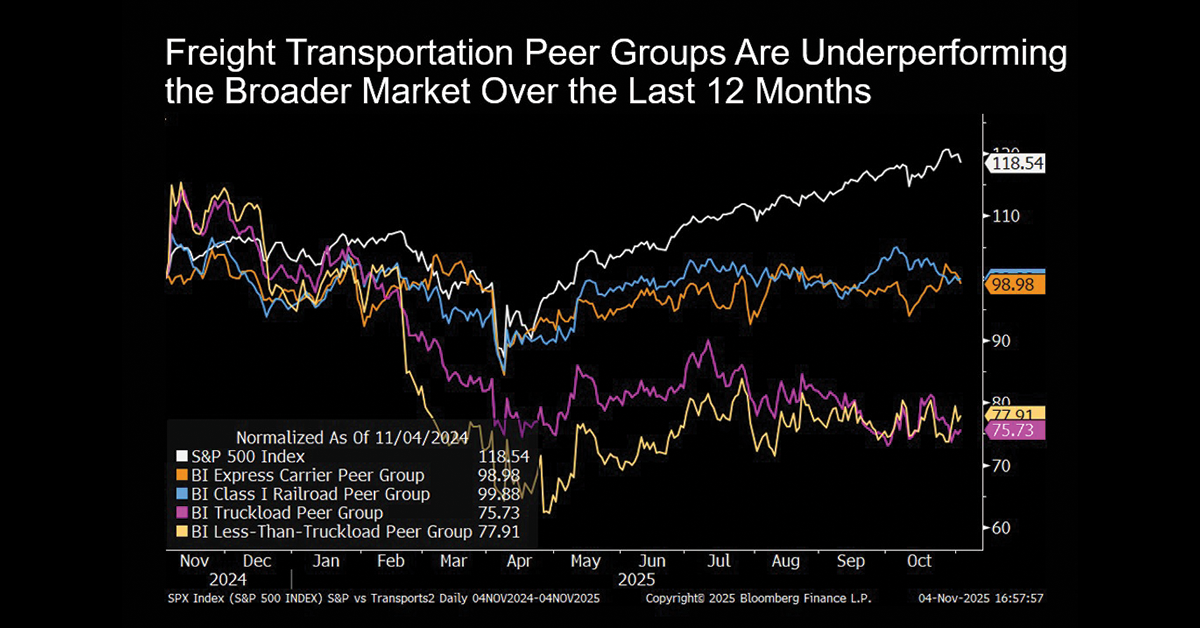

Klaskow began his discussion by providing a key market overview and macro backdrop of what’s going on in the freight markets. Overall, freight transportation peer groups — Bloomberg Intelligence’s Peer Groups involving Carriers, Railroads, Truckload and LTL — have underperformed in the broader market over the past 12 months. He said the trucking peer group has been hardest hit on concerns a rate recovery is being pushed out further by the impact of increased protectionist policies.

Klaskow highlighted that the post-election “animal spirits” have shifted into pessimism, largely driven by tariff concerns and inflationary pressure. There are a number of factors weighing on economic growth and freight demand.

First, the Trump administration tariffs are having a ripple effect on economies and supply chains as they’re likely to be inflationary and will limit the gross domestic product (GDP). Klaskow offered up several key performance indicators and predictions important to supply chains and the economy:

- Probability of a U.S. recession is at 30%, based on consensus.

- The recent de-escalation with China is a step in the right direction.

- Headline Consumer Price Index (CPI) rose 2.3% in April, moderating from 9.1% in June 2022. Tariffs could push inflation higher.

- The ISM Manufacturing Index, the monthly report that tracks the health of the U.S. manufacturing sector, has been in contraction 33 of the past 35 months.

- Industrial economic growth is expected to remain tepid through 2027.

Truckload and LTL Outlook

There are industry concerns that driver supply could be a constraint in any rebound, meaning trucking’s recovery isn’t just about balancing freight demand but also about having enough qualified drivers. Stricter monitoring of areas such as English Language Proficiency, non-domiciled commercial driver's licenses and B1 cabotage may be the spark needed to finally tighten market conditions enough for spot and contractual rates to improve, says Klaskow: “This would bode well for carriers' profitability.”

He also emphasized that spot rates in the truckload sector are bouncing along the bottom, and offered these highlights:

- The North America spot trucking market has had slack capacity since the extremely tight conditions in 2021.

- Truckstop's Market Demand Index (MDI), has loosened in 3Q25 following three tighter quarters. MDI is a weekly indicator that measures relative supply and demand in the North American spot truckload freight market.

- Capacity has been slow to leave the market and has delayed any significant increase spot rates.

- A more normal peak season and increased regulatory enforcement could bode well for the spot rate recovery, which could help push contract rates higher in 2026.

- Spot truckload rates excluding fuel surcharges are up 3.7% on average in 2025 after rising 0.6% last year following two years of double-digit declines. They are currently 1.5% lower compared to last year.

In addition, Klaskow pointed out the average 2025 spot rates by equipment type: Specialized (+5.2%), Flatbed (+3.2%), Dry-van (+2.1%), and Reefer (+1.9%).

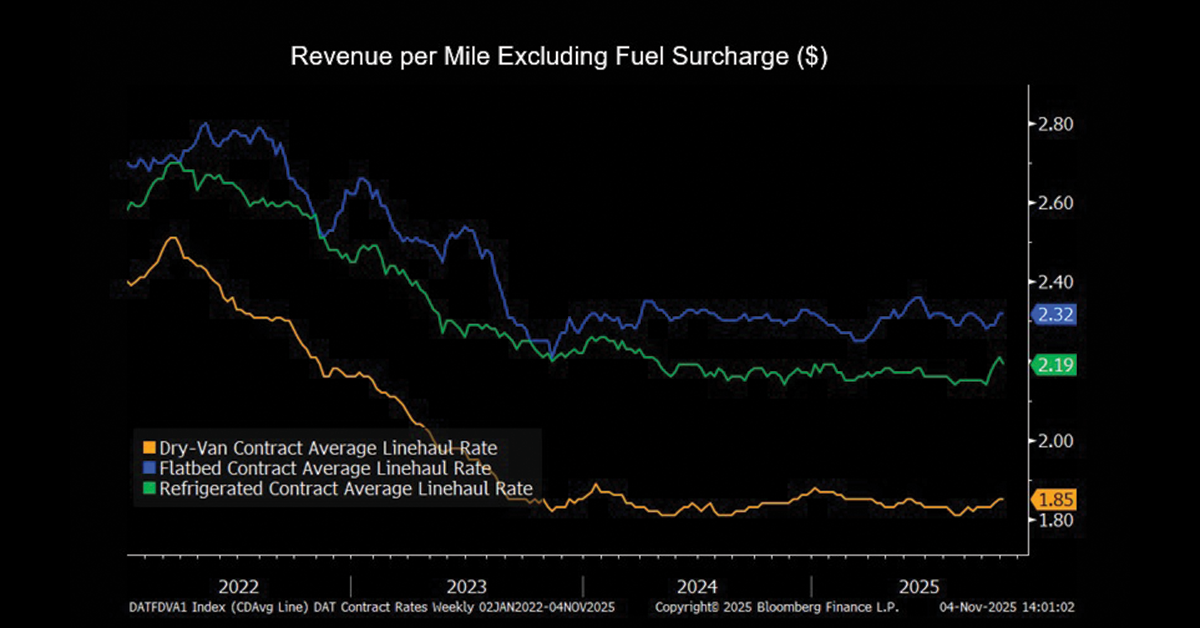

In addition, contract truckload’s market is waiting for spot rates to turn, and offered these observations:

- The weaker spot market has put pressure on contractual rates.

- Truckload contractual rates are down 0.5% on average in 2025 and have declined 17% since 2022 based on DAT data.

- Reefer rates are down the most (by 1.4%), followed by flatbed (-0.4%) and dry-van (+0.5%).

- Tighter spot conditions and a return to normalized demand patterns will be key for contract rate strength.

- Contract rates will not be as volatile as the spot market, which is in the process of rebalancing.

- Average spot-contract spreads contracted 11% to 33 cents from year as of November 2 based on DAT data.

- Contractual rates tend to lag behind the spot market by 6-9 months.

What can we expect to happen in the LTL marketing? “Weak demand and pricing remains rational despite more challenging freight backdrop,” answered Klaskow.

Disciplined rates might not be enough to offset declines in volume, with revenue for the top LTL carriers estimated to fall a median 3.3% in 2025. Carriers are extremely leveraged to pricing (ex-fuel) -- it takes 300 bps of tonnage growth to offset 100 bps in rate declines.

“We expect LTL rates, excluding fuel surcharges, will rise by mid-single digits this year,” said Klaskow.

The industrial environment has yet to recover, with the ISM Manufacturing Index in contraction territory for 33 of the past 35 months. If elevated tariffs stick, they could reduce corporate investment, adding further strains.

LTL revenue finally rose in September after 33 months of declines, increasing 2%, according to the ATA's seasonally adjusted index. Revenue per ton climbed 1.8%, while revenue per shipment fell 1.6%.

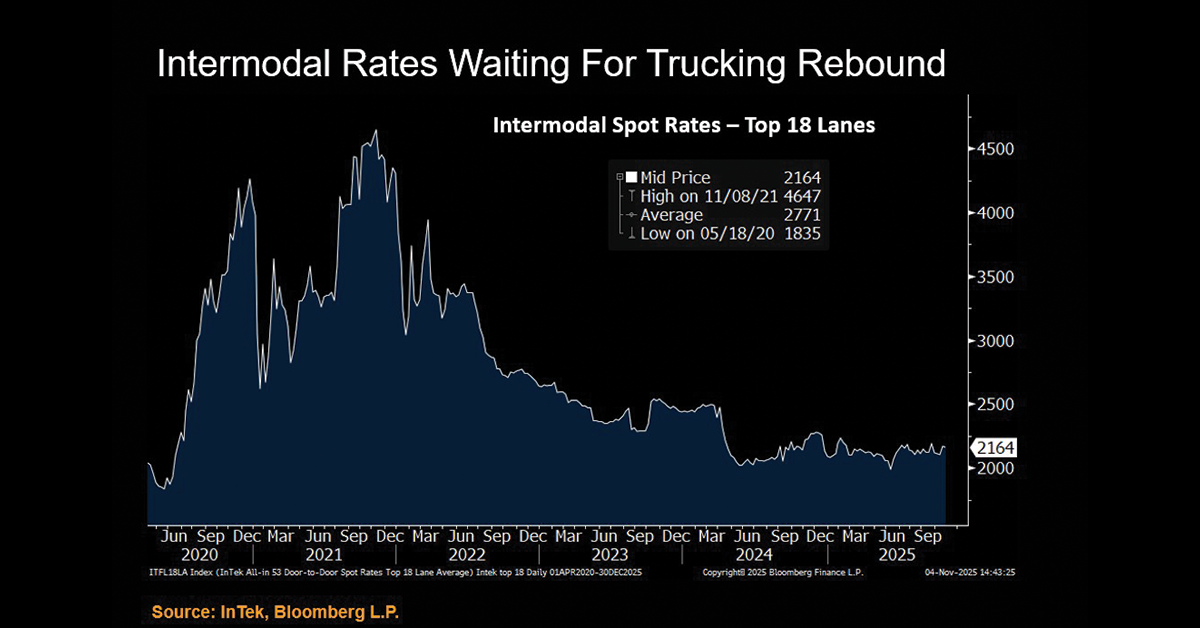

Intermodal Outlook

Intermodal spot rates are falling, inline with the trucking market, says Klaskow. In fact, InTek’s All-In 53-Foot Spot Rate Index is down 4.9% on average in 2025, and rates have declined each year from 2022 through 2024. The Index is a market indicator that tracks the average weekly price of domestic intermodal freight, which is comprised of 115 of the highest volume door-to-door 53-foot domestic intermodal freight lanes offered by the Class I railroads.

“Intermodal rates need tighter trucking conditions to move higher,” suggested Klaskow. “We expect a slow gradual improvement in trucking conditions from here.”

He also noted that lower fuel prices can be a headwind for intermodal demand. Prices are down 4.4% on average in 2025 but up 4.1% from last year.

Railroads have a long history of price discipline, looking to raise rates above rail inflation. Railroads also need to mitigate rising costs, especially as it relates to labor inflation and equipment expenses.

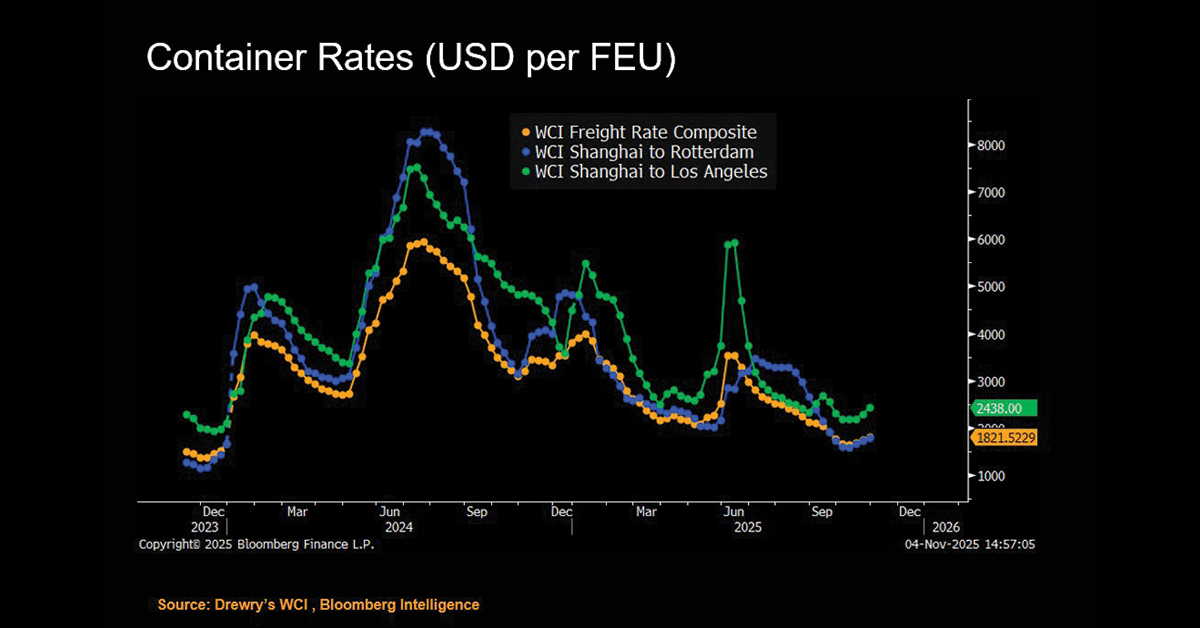

International: Container Liner Finally Get Some Relief

Global liner rates rebounded 10.3% over the past three weeks to $1,822 per 40-foot container in the week ended Oct. 30, according to the Drewry World Container Index (WCI), but remained down 43% from last year. WCI measures the bi-weekly ocean freight rate movements of 40-foot containers in seven major maritime lanes.

New surcharges across all trade lanes aim to mitigate the impact of port fees from the US and China, which may be driving the recent weekly gains, according to Klaskow.

“The U.S. and China trade war appears to be cooling off somewhat following productive meetings between Presidents Donald Trump and Xi Jinping, which should bode well for global trade and economic activity,” noted Klaskow.

He also said that global volume was up 2.8% in August based on CTS data. Traffic from Asia to North America experienced further weakness, declining 12.3% in the latest month and 2.7% year to date.

Supply growth may outpace demand in 2025 and 2026 based on Clarksons’ forecasts. Clarksons Research’s digital platform provides access to powerful data, analysis, forecasts and insights for shipping, offshore, energy and valuations.

Monitoring Freight Markets: An Important Activity for Food Shippers

Understanding freight markets and assessments from economic leaders such as Lee Klaskow helps food companies stay competitive, protect margins, and ensure safe, reliable delivery to customers.

Monitoring freight markets is critical for the food industry because transportation volatility directly impacts product freshness, cost control, and service reliability. Food supply chains are time-sensitive and often temperature-controlled, making them highly vulnerable to delays, capacity shortages, and rate swings. Keeping a close watch on freight trends allows food companies to secure capacity, manage budgets, and avoid disruptions that can lead to spoilage or missed retailer requirements.

Related Articles:

- Trucking Profitability Drastically Squeezed by High Costs, Low Rates

- Economy Factors: Closing In On An Inflection

- Flash Report: A Taxing Time for the U.S. Economy May 2025

- A Closer Look at Trucking and Rail/Intermodal Sector Economic Indicators July 2024

Like this kind of content? Subscribe to our "Food For Thought" eNewsletter!

Now more than ever, professionals consume info on the go. Distributed twice monthly, our "Food For Thought" e-newsletter allows readers to stay informed about timely and relevant industry topics and FSA news whether they're in the office or on the road. Topics range from capacity, rates and supply chain disruption to multimodal transportation strategy, leveraging technology, and talent management and retention. Learn More